IRS Tax Refunds Expected In August 2025 – The tax time may be past but many in the United States await their tax returns by the IRS even up to August 2025. A number of them submitted an amended returns and there are those who submitted paper returns, and some of them are eligible to tax credits such as the EITC or CTC. In case you are expecting the tax refund this month, here is everything you should know- how, when, and why the IRS sends your money back, and what to do when the refund is delayed.

Why does the IRS give tax refunds?

Tax refund is given by the internal Revenue Service (IRS) in the US to individuals who paid more tax in a given year or have claims to the refundable tax credits which would aid them with extra funds. It is not a bonus or free cash–It is money you already paid and you are receiving it back.

Main reasons you get a tax refund

- Overpayment – You receive a refund of the additional payments you have made should you have overpaid on tax or paid too much in estimated amount all throughout the year.

- Assistance to low-income family –Refundable credits are given to low income families like the EITC and ACTC and help them finance their living expenses.

- Economic stimulus- Tax returns give money in the pockets of individuals and this triggers increased spending to stimulate the economy.

- Promote tax compliance – The IRS issues timely refunds to encourage the habit of timely and accurate tax filing.

When will I get my IRS tax refund in August 2025?

The timing of when you will receive your refund depends on when and how you filed your tax return, whether any amendments were made, and whether you claimed any special tax credits.

IRS Tax Refund Timeline

- Electronic filing (e-file) – Refund in about 21 days

- Paper returns – up to 8 weeks

- Amended returns (Form 1040-X) – about 16 weeks

- Returns with EITC or ACTC – Delay due to additional manual review

- If IRS finds a correction or error – can take up to 6 months

- Areas affected by a natural disaster – Refund will be processed only after the new filing deadline

Tax relief for disaster-affected areas

In 2025, the IRS has extended tax filing deadlines for some states to make it easier for affected people to file their tax returns.

- Texas – Flood-affected residents can file until February 2026.

- California – People affected by wildfires can file until October 2025.

If you are in these areas, your refund will be issued only if your filing is completed within the extended deadline and accepted by the IRS.

How to Track IRS Tax Refund?

sources:- How to Track

If you want to know the status of your tax refund, the IRS provides some handy tools and services for this.

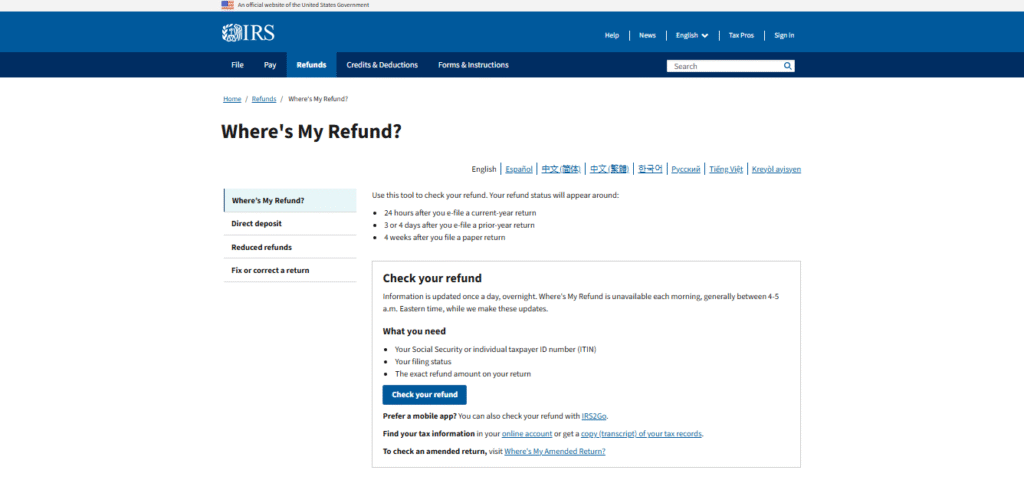

1. Where’s My Refund?

This is available on the IRS website and is updated daily. For this, you need—

- Social Security Number (SSN)

- Filing status (such as Single, Married, etc.)

- Your exact refund amount

2. IRS Automated Phone Support

- For regular returns: 800-829-1954

- For amended returns: 866-464-2050

What if direct deposit fails?

Sometimes the IRS can’t send your refund via direct deposit because of incorrect bank account details or a closed account. In this case—

- You’ll get a paper check sent to your address.

- This may take an additional 2–4 weeks.

Average tax refund amount in 2025

According to the IRS, the average tax refund in 2025 is $3,116. However, this amount will depend on your—

- Filing status

- Income level

- Credits and deductions

Some people are waiting for larger refunds, but returns involving the EITC and ACTC or those undergoing manual review are likely to see longer delays.

Possible reasons for a delayed refund

- Filing a paper return

- Amended return

- Detailed credit investigation

- IRS finds an error or inconsistency

- Extended deadline due to disaster relief

Conclusion

Even in August 2025 in case you still have not received your IRS tax refund, do not sweat. This may take time due to many reasons particularly when you are making an amended return, on paper, or you have credits such as EITC/ACTC.

The advised practice is to follow up the status with the Where is My Refund tool and ensure all your contact and bank details are up to date. That tax rebate amounting to an average of more which is around 3000 dollars can turn your household budget upside down.

FAQs:

Q. How long does it take to get IRS tax refunds in August 2025?

A. E-filed returns usually take around 21 days, while paper returns can take up to 8 weeks. Amended returns may take up to 16 weeks.

Q. Why is my tax refund delayed?

A. Possible reasons include amended returns, manual reviews for credits like EITC/ACTC, IRS error checks, or natural disaster extensions.

Q. What is the average IRS refund amount in 2025?

A. According to IRS data, the average refund is $3,116, but it varies based on income, filing status, and claimed credits.