The US income tax system is known worldwide for its strict rules and complex processes. Paying taxes here is not just a legal responsibility, but is also considered a civic duty. With the aim of making this entire process more transparent, citizen-friendly and equipped with a quick resolution system, many types of forms and documents are prepared by the IRS (Internal Revenue Service).

One of these is IRS Form 13989, which is called the IRS Tax Forum Case Resolution Data Sheet. This form is especially for those taxpayers who want to resolve any dispute or problem during the IRS Tax Forum. In this article, we will understand in detail what this form is, why it is important, what things should be kept in mind while filling it, and how it is helpful for taxpayers.

What is IRS Form 13989?

IRS Form 13989 is an official data sheet that taxpayers fill when they attend the IRS Tax Forum and want a solution to their tax-related problems from the IRS representatives present there. This form is basically a Case Resolution Data Sheet, which includes a summary of your problem, personal information and necessary details.

It is a kind of request letter in which the taxpayer appeals to the IRS to review his case and provide an immediate solution.

What is IRS Tax Forum?

The IRS Tax Forum is an annual event where tax professionals, taxpayers, accountants and other concerned persons gather. New tax rules are discussed in it, training sessions are held, and most importantly – this forum provides a platform for resolving tax-related matters.

Taxpayers present here can put forward their problems in front of IRS officials. If there is a pending tax case, any penalty has been imposed or any refund has not been received, then it can be discussed and resolved. In such cases, Form 13989 becomes necessary.

Purpose of IRS Form 13989

The purpose of introducing this form is:

- To record taxpayers’ issues in a systematic manner.

- To provide IRS representatives with all the necessary information in a single document.

- To ensure quick resolution of cases.

- To make TaxForum a result-oriented platform.

What information is to be filled in the form?

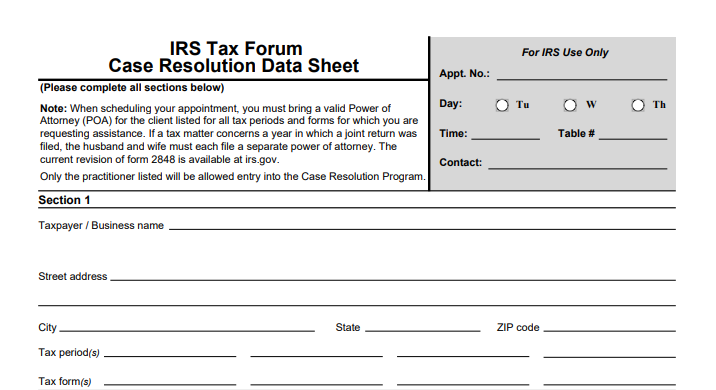

The following information is to be filled in IRS Form 13989:

- Taxpayer’s personal information

- Name

- Social Security Number (SSN) or Taxpayers Identification Number (TIN)

- Address

- Phone number

- Email (if any)

Representative’s information (if any)

- Name

- Company name

- Contact details

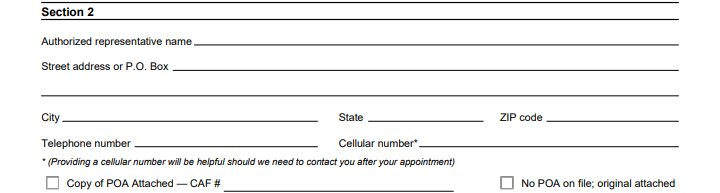

- Brief description of the issue

- The type of tax issue (e.g. refund-related, penalty-related, identity verification, etc.)

- The relevant tax year

- Proceedings till date

Is there any correspondence?

- Which department was contacted?

- Attached documents

- Old letters

- Notices

- Copies of forms

- Identity proof (if required)

- Points to keep in mind while filling the form

- Complete the form with legible, clear and complete details.

- Never volunteer information unless it is sought after, be as concise as possible.

- State your problem in brief but precise words.

- If you are attaching any documents, list them in the form.

- Keep a copy of the form with you.

How and where to submit the form?

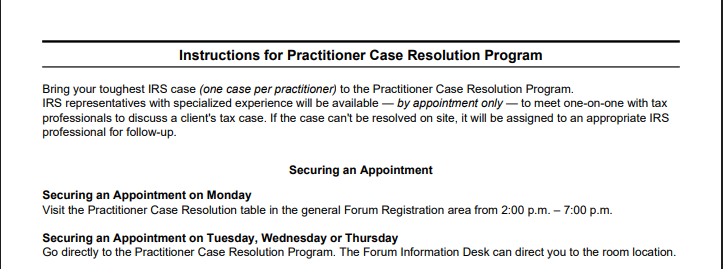

IRS Form 13989 is usually submitted on-site during the IRS Tax Forum. If you have registered online and your case resolution meeting is scheduled, you take this form with you and submit it to the concerned officer.

In some cases, the IRS may accept a digital copy via email or portal, but in most cases it is a physical form that has to be submitted in person.

What happens after submitting the form?

Once you have submitted Form 13989, the IRS representative reviews your case. After that:

- He allots you a case number.

- Necessary documents may be asked for.

- You are informed of the resolution within 30 to 45 days.

- In some complex cases, the time may also take more, but the process remains transparent.

How is IRS Form 13989 useful for taxpayers?

- Direct path to problem resolution: This form gives taxpayers an opportunity to communicate directly with the IRS and resolve the problem.

- Speed of pending cases: Sometimes a tax case remains stuck for years. Through this form, you can go to the Tax Forum and get it resolved quickly.

- Intelligent communication: This form gives taxpayers the opportunity to present their problem in the right way, which reduces the chances of error.

Who should fill this form?

- Taxpayers who have pending cases with the IRS.

- Those who want to present their case in the tax forum.

- Those who want immediate solution from the IRS.

- Those who want to resolve the case with the help of tax advisors.

Is this form different from the normal tax return?

Yes, IRS Form 13989 is completely different from the tax return. It is filled for resolving the case in the tax forum, not for filing taxes. It is filled only in cases when there is a problem, dispute or pending request to be resolved with the IRS.

Conclusion

IRS Form 13989 is a powerful communication bridge between taxpayers and the IRS. It not only helps in resolving the problems of taxpayers but also increases trust and transparency in the tax system.

FAQs

1. What is IRS Form 13989?

IRS Form 13989 is a Case Resolution Data Sheet used by individuals or tax professionals to submit unresolved tax issues for review during IRS Tax Forums.

2. When should I use IRS Form 13989?

You should use this form if you’re attending an IRS Tax Forum and have a tax-related issue that hasn’t been resolved through normal IRS channels.

3. Who can use IRS Form 13989?

Taxpayers, Enrolled Agents (EAs), Certified Public Accountants (CPAs), and other tax professionals can use this form to bring unresolved issues to the IRS’s attention at the forum.

4. What kind of tax issues can be submitted using Form 13989?

Common issues include delayed refunds, misapplied payments, incorrect penalties, unprocessed returns, or other taxpayer service problems.

5. Is IRS Form 13989 only for individuals?

No, it can be used for both individual and business tax issues.