$1,702 Stimulus Payment for Everyone: Amid the ever-increasing inflation and economic instability in the US, Alaska residents have received good news. Thousands of Alaskans are eagerly awaiting the financial assistance that will be given in August 2025 under the Permanent Fund Dividend (PFD) program. The amount received this time is $1,702, which will not only provide financial relief to many families but will also help them meet essential expenses.

The PFD program was started in 1980 and since then it has remained a permanent economic support for the people of Alaska. It not only helps individual families but also boosts the state’s economy by promoting spending in local markets.

Meaning of PFD: Not just a check, an economic movement

It would be wrong to consider the Permanent Fund Dividend as just a check. It is a means of distributing the benefits of the natural wealth that the state receives from resources like oil and gas to the citizens of Alaska. The government decided to distribute this benefit equally across the state so that the benefits of the state’s natural wealth are not limited to companies but also reach the common people.

In today’s economic situation, when inflation is skyrocketing, fuel prices are rising and income remains stagnant, this amount of $1,702 will be helpful for many people to meet essential expenses like electricity bills, groceries, children’s education and health expenses.

Eligibility Conditions: Are you eligible for this benefit?

If you are a resident of Alaska and are wondering whether you are eligible for this amount of $1,702 or not, then you have to read the four key conditions given below carefully. Only those people will be considered eligible for this payment who meet these criteria:

1. Continuous Residency:

- You must reside in the state of Alaska during the entire year of 2023. This means that you must have maintained Alaska as your main place of residence throughout the year.

2. No Foreign Residency Claims:

- You must not have claimed residency in any other state or country in the US during 2023 or received benefits from another government.

3. Clean Legal Record:

- You must not have a serious criminal conviction, particularly a felony conviction. If you have a criminal conviction, you may be ineligible for this benefit.

4. Absence Limitations:

- You must not have been absent from Alaska for a total of more than 180 days in 2023. Exceptions may be made in certain circumstances, but this requirement is generally considered mandatory.

With these conditions in mind, if you believe you meet all of these criteria, it is important to understand the payment schedule below.

When will the next $1,702 payment arrive? Know the complete schedule.

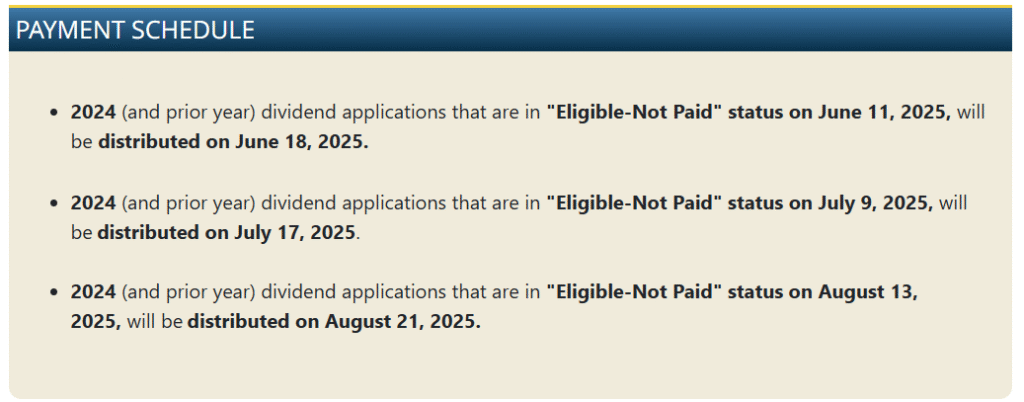

The schedule of PFD payments is decided in advance so that all eligible people receive the amount on time. The next payment due in August 2025 is for those whose application status is recorded as “Eligible – Unpaid.” Below is the detailed schedule of the upcoming payments:

June 18, 2025:

- For those whose 2024 or earlier dividend application status was “Eligible – Unpaid” on June 11, 2025.

July 17, 2025:

- For those whose 2024 or earlier dividend status was recorded as “Eligible – Not Paid” on July 9, 2025.

August 21, 2025:

- This is the next big payment, which will be received by those residents whose dividend status is “Eligible – Unpaid” on August 13, 2025.

As per this schedule, if you have submitted your application on time and you meet all the eligibility criteria, you can receive this amount by August 21, 2025.

How to check the status of your application?

Now the question arises: how do you ensure that your application is correct and you are indeed eligible for payment? For this, you can visit the official website of Alaska PFD and use the “myPFD” portal. This portal shows users the current status of their application, which tells you what stage your file is in—in processing, deemed eligible, or payment has been made.

If you have submitted the application online and used a digital signature, you can update your address and other details directly by visiting the website. But if you have applied through a physical form or you need to make any changes in your address, then you will have to fill out a “Change of Address Form” and submit it to an authorized office. This process ensures that your check reaches the right address on time.

Conclusion: This money is not just help; it is a right.

Alaska’s PFD program is not just financial assistance—it is an entitlement for residents to share in the state’s prosperity. The $1,702 benefit provides relief to individuals and also boosts the state’s domestic economy. Thousands of people await this benefit each year, and it is limited to those who meet all the eligibility criteria and apply on time.

So if you haven’t filled out your application yet, or you’re not sure if you’re eligible—check out the “myPFD” portal today by visiting the official website. Timely action can help you avoid missing out on this valuable fund. Also, share this information with your friends, family and other community members so that everyone can take advantage of this opportunity.

Important Information:

👉 Website: Alaska PFD Official Website

👉 Call for Assistance: (official number, if available)

👉 Check Application Status: myPFD Portal

FAQs

Q. Who is eligible for the $1,702 Alaska PFD payment?

A. Residents who lived in Alaska for all of 2023, did not claim residency elsewhere, have no felony convictions, and were not absent for more than 180 days.

Q. When will the next PFD stimulus payment be issued?

A. The next $1,702 payment is scheduled for August 21, 2025, for those marked “Eligible – Unpaid” as of August 13, 2025.

Q. How can I check the status of my PFD application?

A. Visit the official Alaska PFD website and log in through the “myPFD” portal to view your application status and update your address if needed.

Q. What if I need to change my mailing address?

A. You can update your address online if you signed electronically. Otherwise, submit a Change of Address Form to a designated PFD office.

Q. Is the PFD payment taxable?

A. Yes, the Alaska PFD payment is considered taxable income by the IRS and must be reported on your federal tax return.