$1,702 Payment Schedule Released – In today’s time, inflation is at its peak, unemployment has become a common problem and the budget of the common man deteriorates every month. In such a situation, any financial help from the government is like a life-saving step. This relief is no less than a boon for families surviving on limited income.

The northern US state of Alaska has taken a historic and sensitive step for its citizens in 2025. The state government has announced that eligible citizens will be given financial assistance of $1,702. This amount will be provided under the Alaska Permanent Fund Dividend (PFD) scheme and will be distributed in two installments in May and August 2025.

This is not just a monetary help, but a symbol that the state is serious about the future of its citizens and their welfare.

What is the Alaska Permanent Fund Dividend (PFD) scheme?

The PFD scheme was started in 1976, when the Alaska government decided that a part of the income from the state’s natural assets – especially oil – would be shared with the citizens there. For this, the Alaska Permanent Fund Corporation (APFC) was formed, which oversees and invests this fund.

This institution invests this money in global stock markets, bonds, real estate and other financial instruments. Every year, a portion of the profit from these investments is distributed among the permanent residents of Alaska.

The PFD plan not only symbolizes economic cooperation, but it also reflects the spirit of social justice. Its message is clear – the benefits of the state’s assets should not be limited to large companies, but its benefits should also reach the general public.

How much and how will the money be received in August 2025?

In 2025, each eligible person will be given a total of $1,702, which will be divided into two parts:

- $1,403.83 – the main dividend amount, which is based on the annual performance of the fund.

- $298.17 – additional bonus, called Energy Relief Assistance, and it will be given in view of rising energy costs.

This amount has been decided based on the fund performance of 2024. Experts believe that this amount may remain stable. This help is very useful, especially in winter, when energy consumption is very high.

Who is eligible for PFD?

The eligibility criteria are simple but must be met faithfully:

- Living in Alaska for the entire calendar year of 2024 and declaring it as your permanent residence.

- Physically present in Alaska for at least 72 hours in either 2023 or 2024.

- If you spend more than 180 days outside Alaska in 2024, provide a valid reason – such as studies, medical treatment or military service.

- Not committing a serious crime in 2024.

- Each individual must apply separately, with children also filling out a separate form.

- Having a driver’s license or address from another state may affect your eligibility.

The application process is completely online and easy

Sources:- pfd.alaska.gov

The PFD plan application is completely online and is extremely easy, provided you have all the required documents:

- Visit the website: pfd.alaska.gov

- Login to your myAlaska account or create a new account.

- Fill in personal information, bank details and proof of residence.

- If you were temporarily out of Alaska, upload proof of the same (such as a school certificate, medical document or military service letter).

- Check all the information carefully and submit the form.

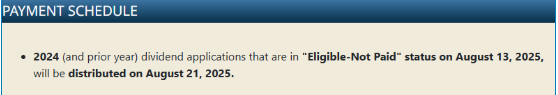

Estimated payment Schedule of August 2025

Sources:- pfd.alaska.gov

| Status Approval Date | Expected Payment Date |

|---|---|

| By August 9, 2025 | August 17, 2025 |

| By August 16, 2025 | August 24, 2025 |

| By August 23, 2025 | August 31, 2025 |

If your application is approved on time and all the information is correct, the amount will be deposited directly into your bank account.

Common mistakes in application

Many times people are deprived of the amount of $1,702 due to small but serious mistakes, such as:

- Missing the application deadline

- Providing the wrong or old bank account number

- Hiding information about living outside Alaska

- Incomplete documents or filling the wrong form

Therefore, it is important to be very careful while applying.

Will I have to pay tax on this amount?

The state of Alaska does not levy any tax on this amount, but the US federal government (IRS) considers it Taxable Income. If your annual total income falls in the tax bracket, you will have to pay tax on this amount. So it would be better if you do tax planning in advance.

What if you do not apply?

If you do not apply by April 2025, you will be deprived of this year’s relief amount. Late applications are not accepted in the PFD scheme. Then you will have to wait for the next year i.e. 2026 application cycle.

Conclusion – Apply on time, get full relief

This amount of $1,702 is not just a transaction of money, but it is a symbol of trust between the government and the citizens. It shows that a state can stand with its people.

If you are eligible, then this is a golden opportunity for you to improve your financial condition. All you need is the right information, timely action and a little caution.

Remember:

- Be aware of and meet all the eligibility requirements.

- All the necessary documents are to be prepared, and appropriate information is to be put into them.

- Ensure that you have checked your application status and the payment date.

It is quite possible with some preparation, with some awareness, with some caution to maximize this relief scheme.

FAQs:

Q. What is the Alaska Permanent Fund Dividend (PFD)?

A. It is a program that distributes a portion of Alaska’s natural resource revenue to eligible residents every year.

Q. How much will be given in 2025?

A. A total of $1,702, divided into two parts – $1,403.83 as the main dividend and $298.17 as Energy Relief Assistance.

Q. When will the payments be made?

A. Payments will be made in May and August 2025, with specific August dates depending on approval timing.